Helping people to Trade with

Less Risk

Less Stress

Trading is 80% of psychological and 20% logical. Taking calculated risk with hedging is the best option to trade!

Options Mastery Course

- (Option Buying, Option Selling and Spreads)

Apr 23 - May 08

Tamil

- Monday - Friday

(07.00 p.m. to 09.00 p.m.)

- Saturday

(05.00 p.m. to 07.00 p.m.)

Mar 18-30

(07.00 p.m. to 09.00 p.m.)

Tamil

Mar 18-30

(05.00 p.m. to 07.00 p.m.)

Tamil

Who Can Attend This Course

- Full-time Traders who want to trade peacefully with less risk.

- People who want to do part-time trading , without spending much time in the market.

Live session (zoom) 25 + hours of content + Materials

Recordings And Materials Also Provided!

1 live market session during weekdays

Telegram Community For Free

Options Mastery Course

- (Option buying, Option selling and Spreads )

Apr 23 - May 08

- Monday to Friday

Mar 18 - 30

(07.00 p.m. to 9.00 p.m.)

Tamil

- Saturday

Mar 18-30

(05.00 p.m. to 07 p.m.)

Tamil

Live session (zoom) 10 + hours of content + Materials

Recordings And Materials Also Provided!

1 live market session during weekdays

Telegram Community For Free

Course Modules

- Basics of candlesticks

- Demand zone and supply zone types and markings .

- Identifying and marking the important chart patterns.

- Identifying fake breakout/breakdown and retesting.

- Indicators to confirm high-accuracy setups

- Multiple timeframe analysis.

- Checklist to confirm high-accuracy trade setups.

- Customised Screener to select stocks for intraday trading.

- How to set entry and stop loss as per the risk capacity ?

- How to set the target based on the zones?

- Marking the crucial levels!

- Difference between Option buyers and option sellers

- Strike price and expiry selection

- Tips to avoid premium decay.

- Option greeks ( Delta , vega , theta)

- Decoding jargon like Breakeven point ( BEP ), India vix, Physical settlement,pay off chart reading, etc.

- Directional view strategies for intraday as well as positional trades

- Bull call, bull put spread, bear call, bear put spread

- Expiry day strategies using option buying

- Long straddle & long strangle

- How to hedge futures with option buying?

- Strike price and expiry selection for futures hedging for positional trading.

Are you a complete beginner?

Try This combo!

Stock market investment course

Rs. 300 /-

Stock market investment course Rs. 300 /-

+

Swing Trading Course

Rs. 1200 /-

+

Options mastery course

Rs. 3000 /-

Available at 10% offer

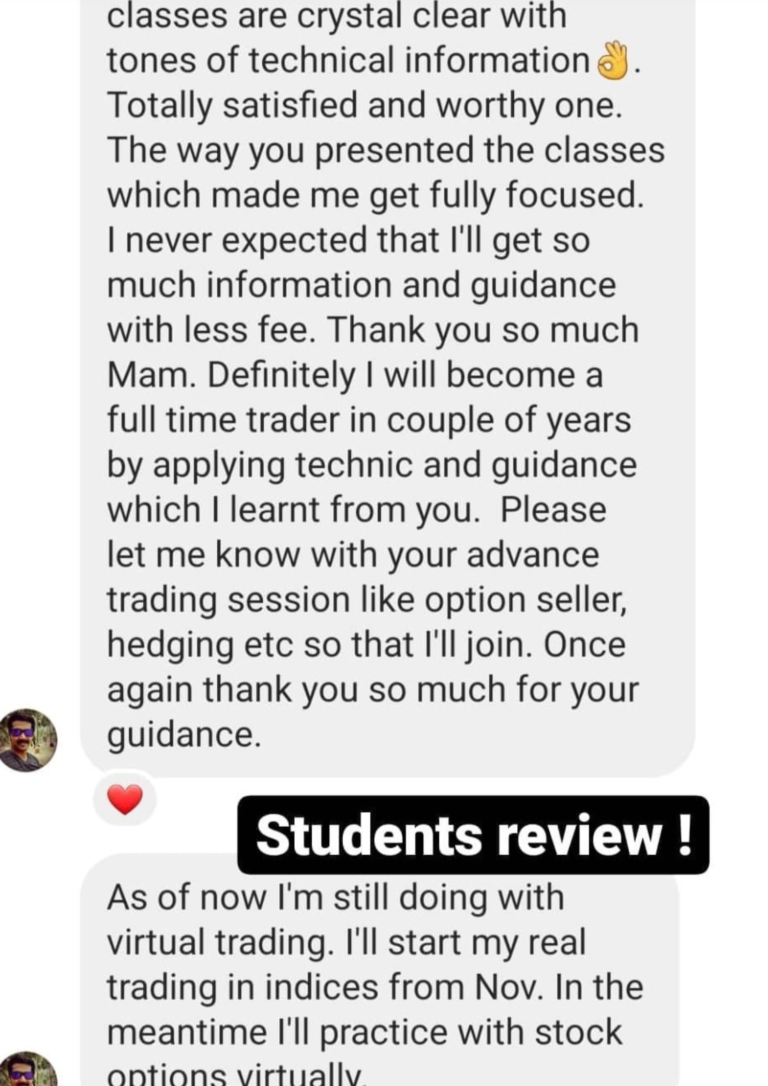

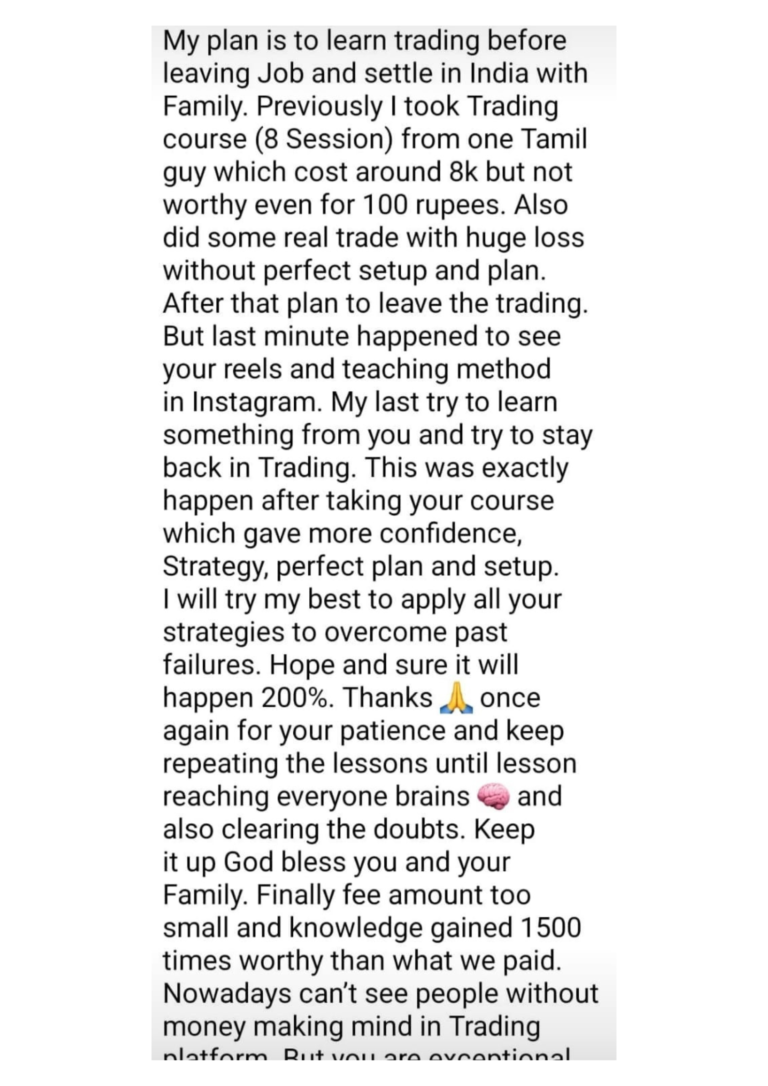

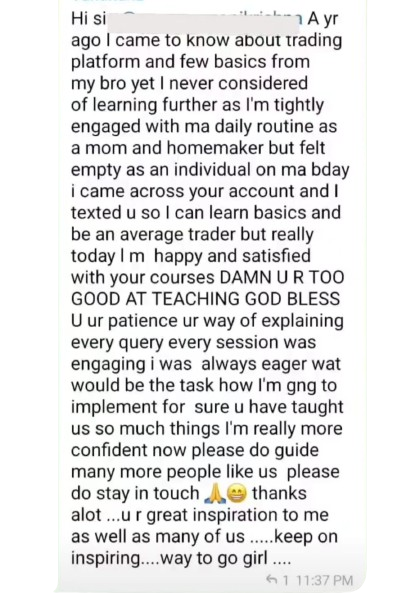

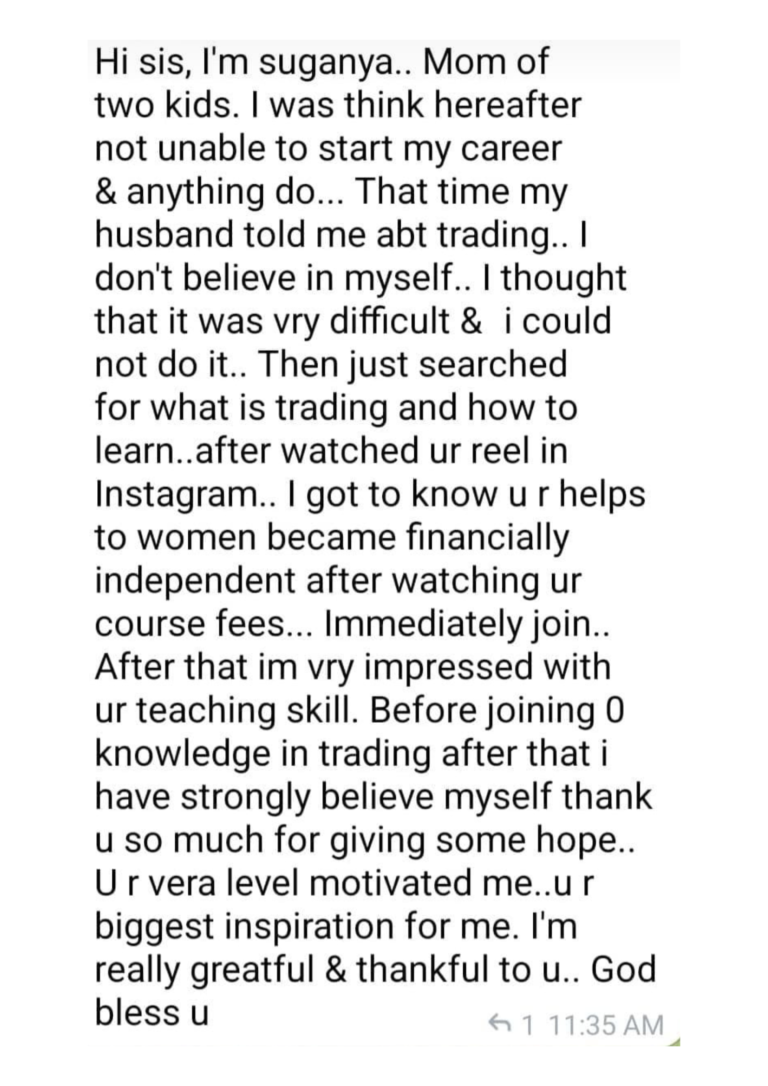

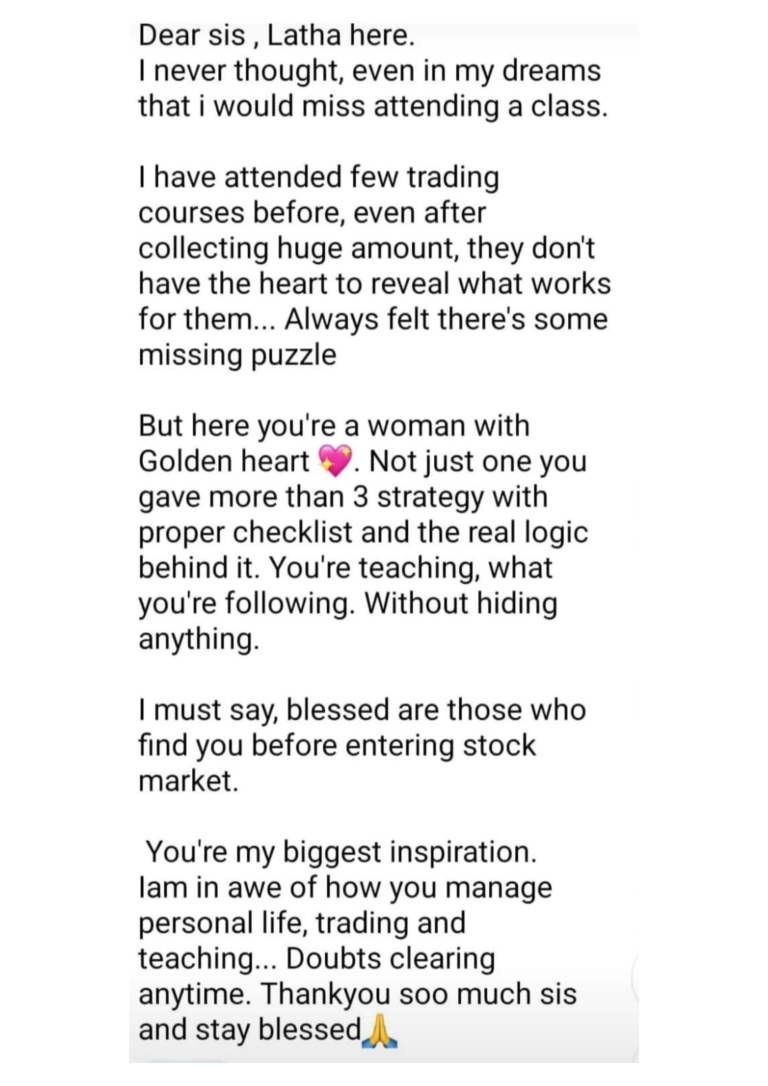

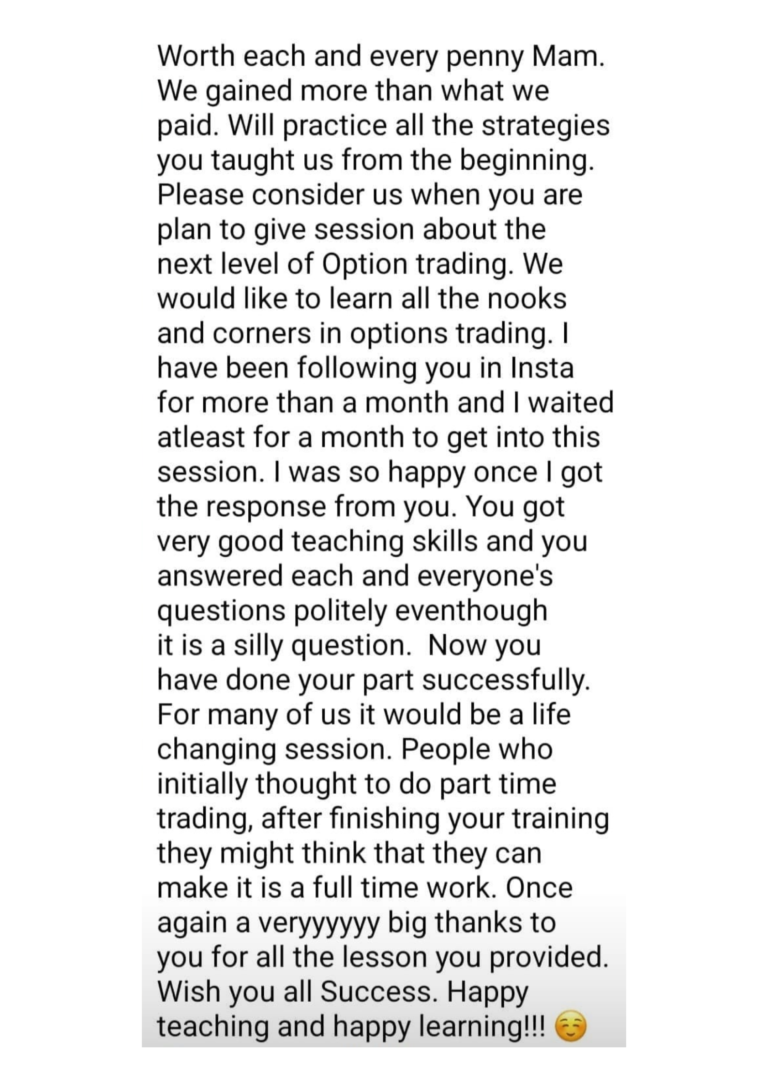

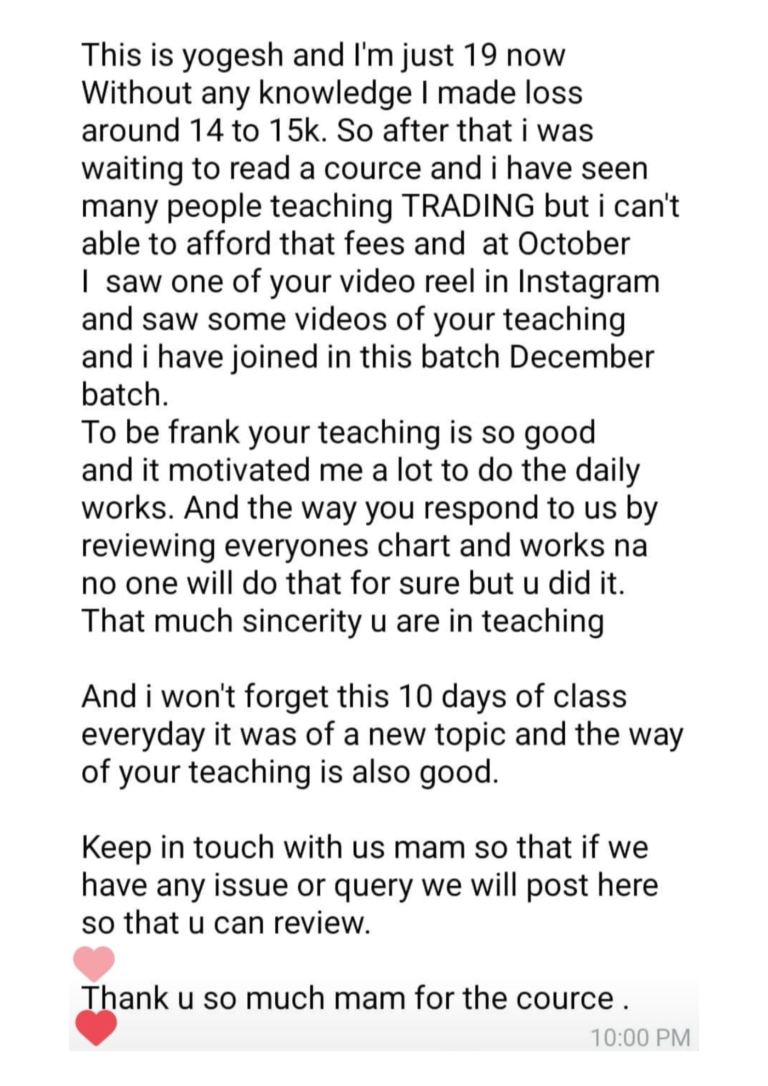

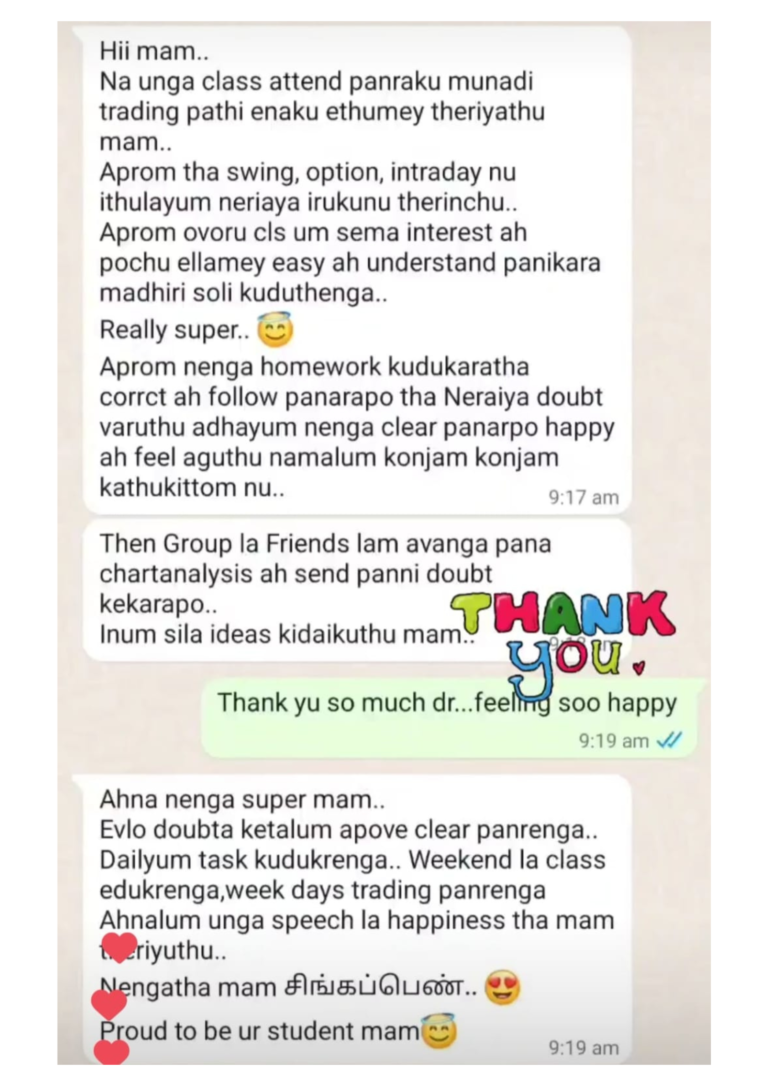

What Our Learners Say About Us

Course Instructor

I'm Saranya Gopikrishna,

I started

Stockbrok Academy

..with a mission to bring financial literacy to 1 million people.

So far, I have Trained 4500+ students and have received excellent reviews !

I’m a B.E. ,MBA graduate in Finance , NCFM certified Technical Analyst and NISM certified Research Analyst ( RA ) with 3+ years of experience in Stock market! !…

We have come so far!

Let's Stay in

touch!

Want to chat?

With Our Support

Team ?!

To Open Free

Trading account in

Upstox ?!

FAQ

This course includes both option buying and option selling .It also includes options and futures hedging strategies..

It depends on the trading style we choose. For option buying , we can start trading with 10k capital in indices , 25k to 30k in stocks. Whereas in option selling , we need approximately 1 lakh capital.

Incase of hedging strategies , capital required is around 20k for indices , around 40 to 50k for stocks.

Among option buying , option selling and hedging , the less risky one is hedging.It is because we are taking calculated risk.

Option buying is suitable for intraday only . But hedging strategies can be used for intraday as well as positional trades.

It controls premium decay , and it reduces stress and risk , since the loss amount is already predetermined.

Yes , everything is taught from basics only. However it is recommended to take as combo with the investment course and swing trading course as it will give complete knowledge.

Yes, recordings will be shared after each session.